Unlimited Hedge Fund Barometer - 1st Quarter 2024

Subscribe to Our Blog

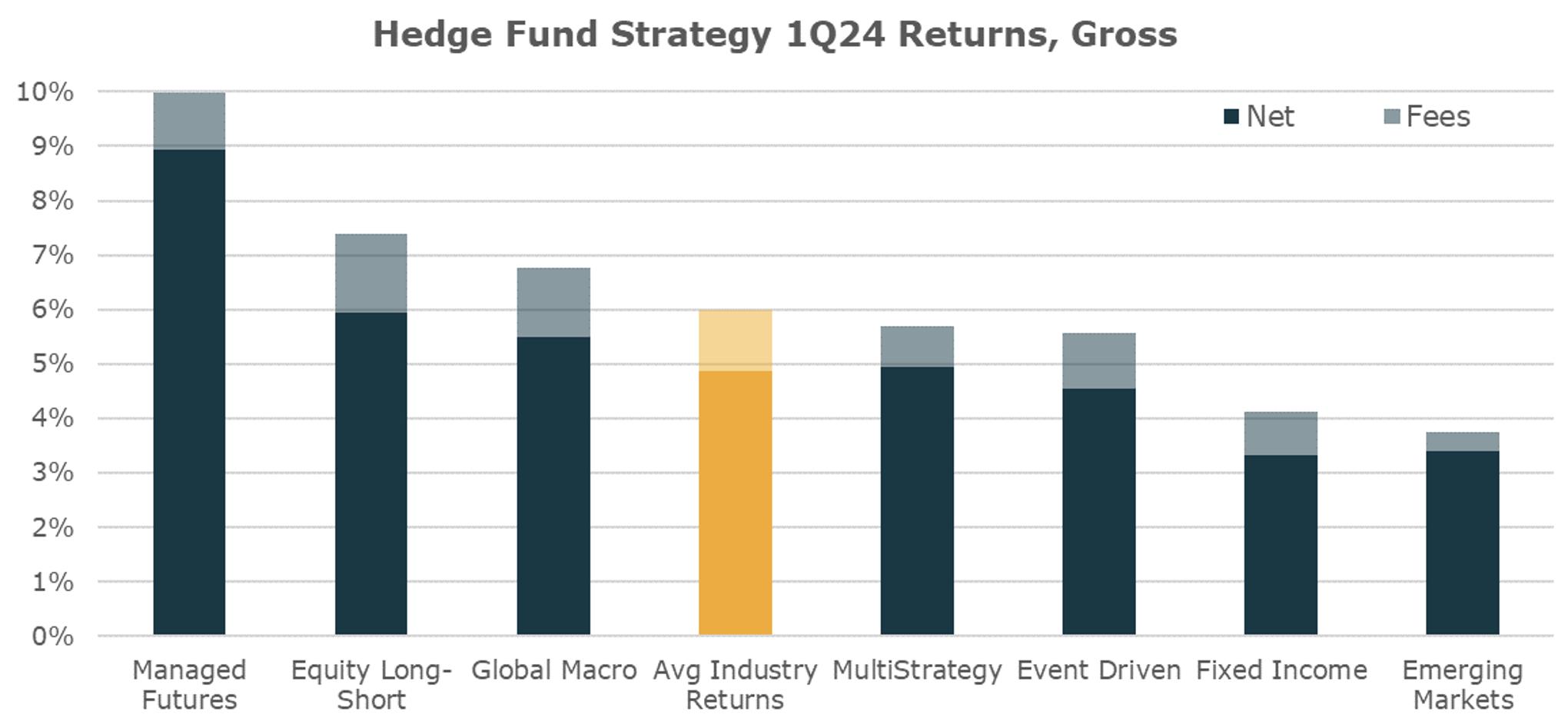

1Q24 Hedge Fund Strategy Performance (Gross of Fees)

- Industry Return: 6.0%

- Best Performing Fund Style: Managed Futures (+10.0%)

- Worst Performing Fund Style: Emerging Markets (+3.8%)

Commentary

Hedge Fund performance in the first quarter was the best in more than 3 years, driven by an unusual combination of higher than normal returns from both equity-oriented funds and trend/macro funds.

Managed Futures and Global Macro funds' strong performance benefited from long positions in US and Japanese equity markets, dollar longs against several crosses, and long positions in surging agricultural commodities. Long/Short Equity managers shift to above-average risk taking for the first time in years drove higher than normal returns in addition to cyclical sector overweights like homebuilders and financials. Emerging Market managers’ continued to be dragged down by exposure to weak Chinese markets and Fixed Income managers' returns were modest with most credit spreads already near lows.

The industry was well positioned in the quarter for a stronger than expected global economy and rising inflation pressures (particularly in the US). Fund positioning remains well below peak in equity risk and conservative across cyclical sectors, US bonds and gold. While many investors are already close to their maximum positioning, many hedge fund managers look in a position to reinforce recent market moves.