Subscribe to Our Blog

The last year has all of us wrestling with whether our investment gameplan will work in a wide range of different macroeconomic environments. Many investors have only had careers during the last 15 years of extraordinarily stimulative monetary policy; or, for those with more tenure, careers only during a period of secular disinflation. For most investors, those dynamics meant that some version of 60/40 (a portfolio where 60% is invested in stocks and 40% in bonds) worked pretty well, and for much of the period since the GFC, the riskier the stocks - or the more private equity or venture capital in portfolios - the better. But the last 15 months have shown otherwise.

The challenge of creating a clear gameplan today is the significant uncertainty that lies ahead. Will it be a long-term period of stagflation, monetary stimulation, deflation, cyclical chop, or something else we haven’t thought about like global war? Even professional investors recognize there has rarely been this much uncertainty. Crafting an investment gameplan requires building a portfolio that can withstand a wide range of possible outcomes.

For those who have relied on 60/40 and similar derivations throughout their career, preparing a portfolio for a wide range of outcomes can feel like a daunting task. Many investors and advisors are searching for what the new 60/40 will be or, said differently, what is the simple investment gameplan that could work across the possible environments that may come. While probably nothing will be as simple as 60/40 given its limitations, it doesn't take too much additional work to get to a portfolio that could be an improvement.

Designing a Simple Gameplan

Creating a portfolio requires starting with some of the fundamental principles of how markets and investing work. We started with six fundamental principles below that are drawn from our decades of investing experience and then work from those to an asset allocation that aligns with them. The result is a more complex portfolio than 60/40, but is relatively manageable and one that has the promise to hold up to tests across a wide range of macro environments.

It starts with the assumption that holding assets is better than holding cash in the majority of circumstances. From there is the assumption that a balanced portfolio tilted toward inflation protecting assets improves purchasing power over time. And finally, it includes the assumption that both trend following and diversified alpha strategies can improve portfolio risk/return if low cost managers are found.

The typical portfolio allocation based on those principles is shown below. Under normal conditions the portfolio is fully invested in financial assets and strategies as shown below. Only during periods where central bank tightening is relatively fast (>100bps over 6m) does the investment process hold cash instead of being fully invested.

The goal of this portfolio is to generate returns that are more reliable across a wider range of economic environments than either cash or a traditional 60/40 portfolio. To assess this, we looked at the performance of this strategy since 1970, a period with a very wide range of different environments. When we use this “simple gameplan” approach, we find returns that are on par with 60/40, but which are much more consistent:

The results depicted are simulated results and do not represent returns that an investor attained. Past performance is not indicative of future results. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.

Below we discuss the core drivers of the underlying approach, give perspective on the historical performance through many cycles, and then finally offer some practical perspective on how the approach could be implemented today.

The Investment Principles Used to Design the Simple Gameplan

To build this Simple Gameplan portfolio we started with a set of six key investment principles that we think drive portfolio returns over time. Each of these may seem relatively obvious, but it is useful to think about each independently because they imply a different incremental step in portfolio construction (below). Put together, they form the conceptual foundation of our Simple Gameplan.

But before we get to those, it's important to remind ourselves that there are three key sources of return for any investment portfolio:

- Cash - returns from holding a risk-free investment

- Beta - passive collecting of risk premiums from investing in risky assets instead of cash

- Alpha - returns that are generated from active management

Our principles touch on effective ways to construct each of these. The first two describe the reasons to hold assets against cash. The second two describe an efficient beta portfolio for most investors. And the final two describe an effective approach to generating alpha in the context of an asset portfolio.

The reason to make these so explicit is that you can wrestle with whether you believe each one and whether you think it makes sense as a way to manage an investment portfolio. After this, we show each incremental step, which you can evaluate on its own for whether it makes sense to include in your investment gameplan.

For informational and educational purposes only and should not be construed as investment advice.

How the Simple Gameplan Performs Across Different Macroeconomic Environments

We then took these principles and translated them into a systematic investment process that we could test through different market environments. In order to get a wide range of possible outcomes, we simulated the performance back to 1970 and studied the incremental benefit of the investment implications of each principle above.

In order to run this, we had to make some simplifying assumptions. The simulation uses asset and cash returns, which are widely available. Trend following was based on a simple 12 month change for bond and stock returns to determine a position in the following month. This approach has historically created outcomes on par with more sophisticated trend following approaches. Diversified Alpha returns were a simulated return stream constructed assuming a 0.3 equity market beta, 300bps of alpha net of fees, and a 1.0 alpha Sharpe ratio. These characteristics are consistent with the return characteristics of the hedge fund industry gross of fees returns net of a 100 bps fee over the last 20 years.

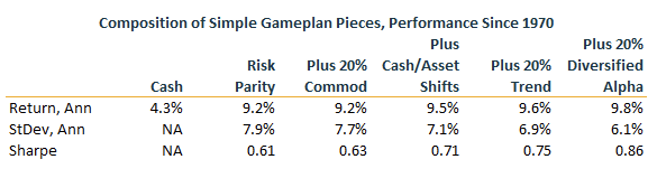

The table below gives a sense of the impact of the incremental inclusion of each piece to the overall portfolio. Each piece adds value to the portfolio incrementally, and the result is considerably better returns than cash, but also better outcomes than just passively investing in a balanced set of financial assets.

The results depicted are simulated results and do not represent returns that an investor attained. Past performance is not indicative of future results. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.

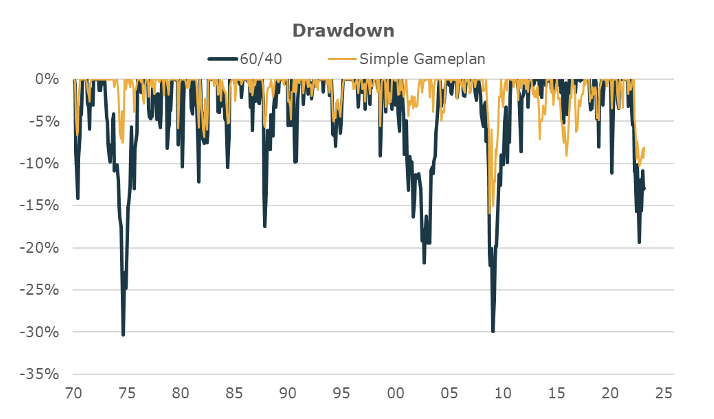

The Simple Gameplan also shows more consistent returns over time than a typical 60/40 portfolio. The chart below shows the simple cumulative returns of each portfolio in order to be able to see the evolution of the returns through time without the visually distortive impacts of compounding.

The results depicted are simulated results and do not represent returns that an investor attained. Past performance is not indicative of future results. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.

Creating the Simple Gameplan Portfolio Today

There are many tools that exist in order to build this portfolio today for investors who are interested in implementing a similar approach. Allocating to each concept noted in the pie chart can be done many ways, which is why they were described conceptually. That said, there are some easy ways to get exposures to each concept leveraging ETFs or other low-cost products to help get you started.

Below we highlight some approaches to attaining these exposures:

Cash - Can be held in several ways. The $BIL ETF is a low-cost solution, or many brokerages will have cash earning accounts.

Risk Parity - This refers to an investment approach that creates a portfolio that is balanced across different economic environments. Several versions of these products exist, with the $RPAR ETF being one of the most straightforward versions.

Inflation Tilt - This refers to holding assets that do well in inflationary environments such as commodities or gold. There are several ways to get exposure, though for most retail investors $BCI and $IAUF ETFs are two options that do not have K1s.

Trend Following - There are many versions of trend following, including investors doing their own assessments (say based on the 12m price change) or outsourcing the approach to other managers. Several ETFs offer these strategies including $DBMF, $KMLM, and $CTA, all of which capture trend following in various ways.

Diversified Alpha - Getting access to alpha managers in a relatively low-cost way is difficult for many investors. There are several products that capture these approaches, which can be found on Morningstar by looking at the US Fund Multistrategy sector.

A New Investment Gameplan Ahead

The past few quarters have challenged much of what many of us have learned through our investment careers. And the future offers more uncertainty than many have seen in decades. The old paradigms did not serve most investors well during the period and challenged us to find a new approach that offers the possibility of improved outcomes across a wide range of possible macroeconomic environments.

The Simple Gameplan above is certainly not a perfect solution, but it leverages modestly greater complexity to achieve what we expect to be a more robust portfolio outcome across a wider range of macro environments. While there is still a lot of uncertainty about what the future will bring, what we feel confident in is that the old world of “60/40 and forget it” may soon become a relic of the past.

Simulated, backtested, modeled, or hypothetical performance results have certain inherent limitations and are for illustrative purposes only. Such results are hypothetical and do not represent actual trading, and thus may not reflect material economic and market factors, such as liquidity constraints, that may have had an impact on actual decision-making. Such results are also achieved through retroactive application of a model designed with the benefit of hindsight and cannot account for all financial risk that may affect actual performance. No representation is being made that any investor will or is likely to achieve results similar to those shown. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment. For informational and educational purposes only and should not be construed as investment advice. It does not constitute an offer to sell or a solicitation of an offer to buy any security. Opinions expressed are our present opinions only. No Representation is being made that any investment will or is likely to achieve profits or losses similar to those shown herein. This material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. The historical analysis should not be construed as an indicator of the future performance of any investment vehicle that Unlimited manages.