Far From Perfect: Inverted Yield Curves Don't Reliably Predict Recessions or the Direction of the Markets

Subscribe to Our Blog

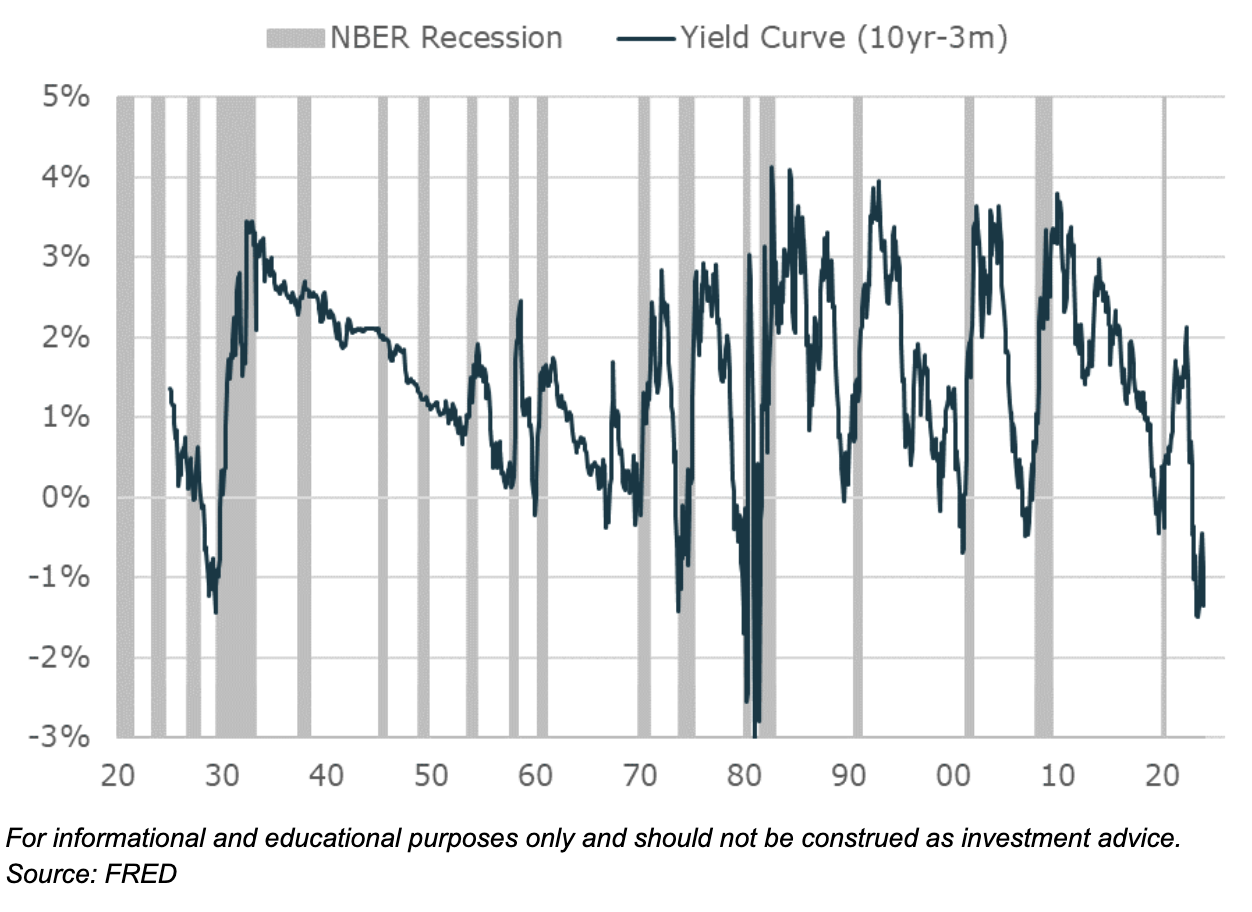

On October 25, 2022 the yield curve flipped to inverted and has remained so for the nearly 500 days since. Recession was inevitable according to economists and many investors. After all, for decades yield curve inversion has been the go to signal of a recession ahead*. It's even been called “perfect”. Despite all that history and confidence, no recession has come. Instead the US economy is on track to experience its 7th quarter at or above potential growth and the S&P 500 has risen nearly 40%. For investors it was precisely the wrong signal.

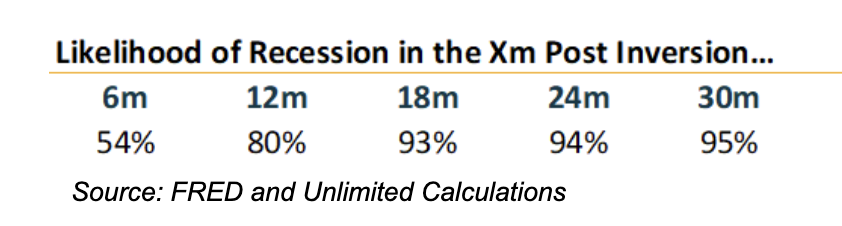

While yield curve inversion has had a good track record leading subsequent U.S. recessions in the post-war period, the trouble for investors is that the lead time is extremely unreliable. Historically, in instances where the Yield Curve has been inverted the range of outcomes has been everything from being coincident to a recession, to leading by 30 months or longer (in the case of ‘66).

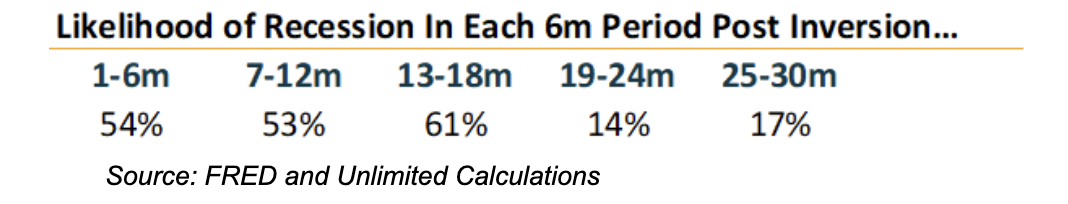

For traders what happens 30 months in the future isn't all that helpful. What is more relevant is what is likely to transpire over say the next 6 months or so. Looking closer at that time frame highlights that in any 6 month period following yield curve inversion the chances that a recession comes are much closer to 50/50 than 100%. It's a coin flip. As the period moves further out beyond 18 months, the probability of predicting a recession falls closer to the long-term average U.S. recession probability (15-20% of months).

After roughly 16 months from the point of initial inversion recession has yet to occur. Atlanta Fed GDP Now has GDP at nearly 3% for 1Q24, nothing close to recession, and measures of employment and demand have remained quite strong. There is little indication that a recession is imminent. If history is any indication, once the first 18 months pass post-inversion without a recession, the probability of its occurrence in the next 6 months is closer to the average chance of recession. At this point relying on the recent yield curve inversion as an indicator for recession has no edge over rolling a die and it coming up 1. It might be time to start recognizing that at least this cycle, yield curve inversion was a whiff.

Not Only Is Yield Curve Inversion A Mediocre Recession Predictor, It Sucks As An Equity Indicator

Predicting recession isn't all that useful for investors since investors don't trade economies, they trade markets. But that didn't stop many from quickly connecting the yield curve inversion to being a good reason to underweight stocks at the end of 2022 and through much of 2023. After all, if you believe markets lead the economy and yield curve inversion leads the economy, then an inversion has all the hallmarks of a big equity market decline.

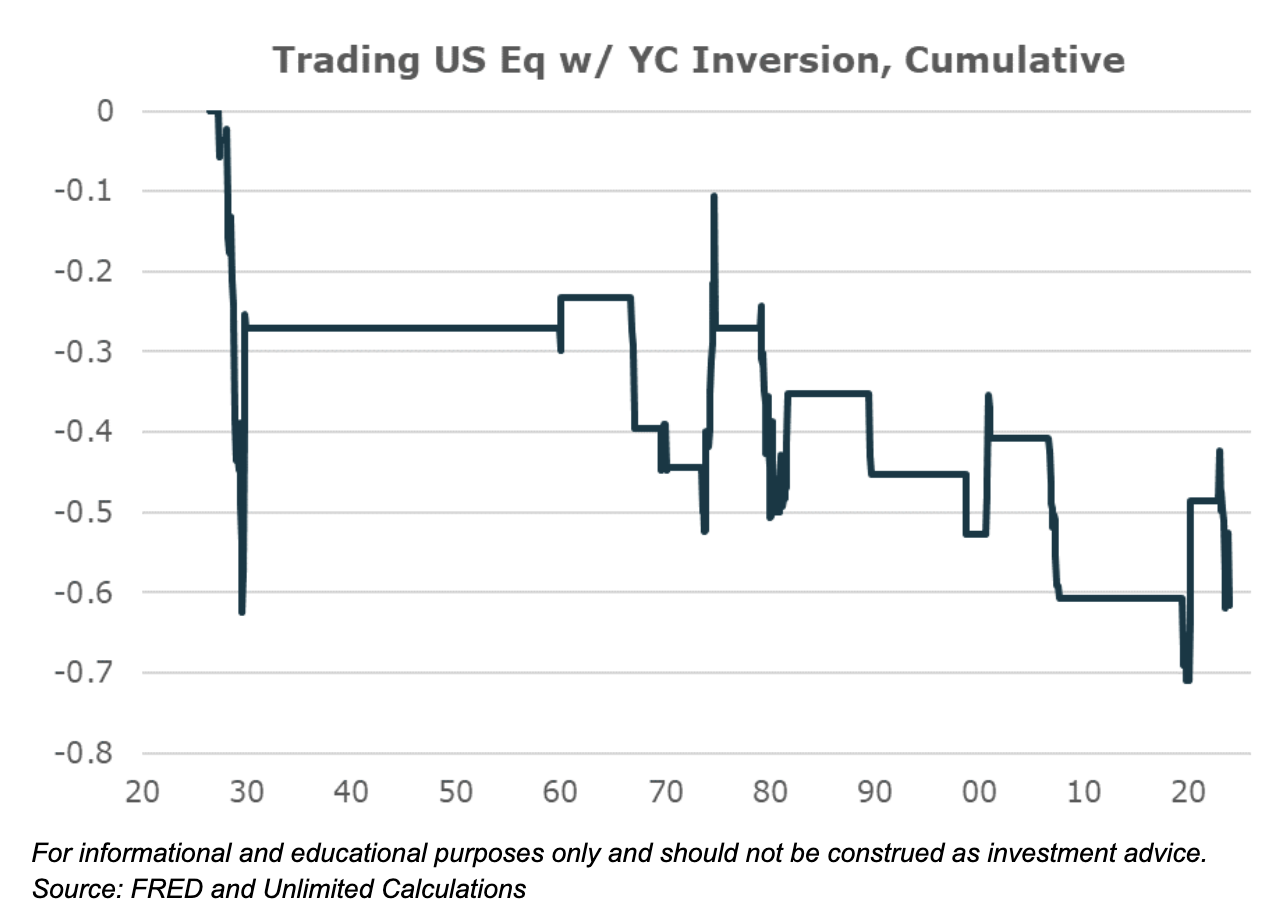

But there is no reason to speculate on this idea. It can be easily tested. The data indicates that yield curve inversion is quite an ineffective indicator to trade stocks. The chart below shows the return of trading stocks short when the Yield Curve is inverted. That indicator has generated negative returns over the last 100 years with a hit rate closer to random than positive. Positioning that one might say is as good as a coin flip, maybe worse.

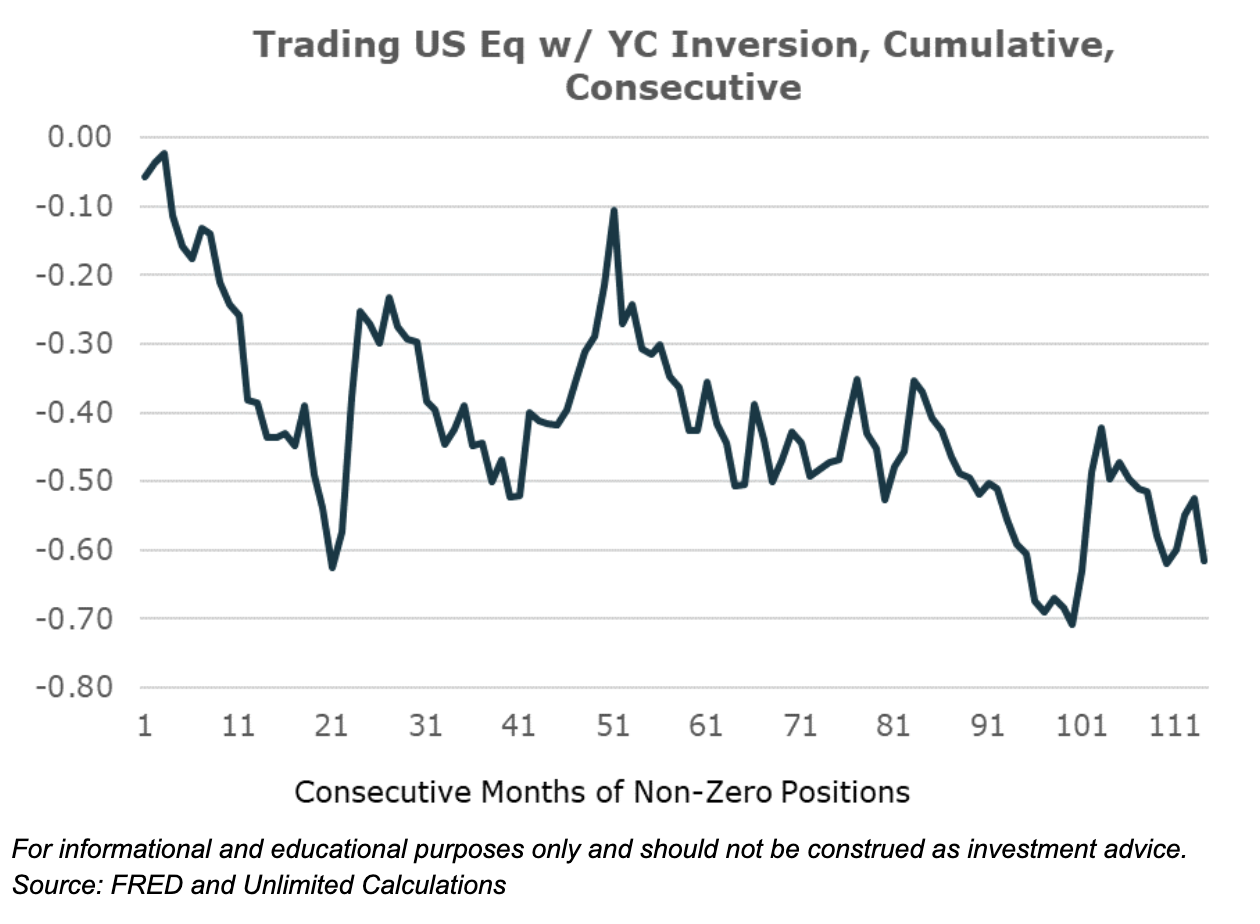

Accumulated over consecutive months is no better.

We are presented with a classic example of how expectations often influence market pricing which means that using well-worn leading economic indicators is unlikely to generate alpha. Think of it this way: If everyone knew that a recession was going to come it would already be reflected in stock prices. Yield Curve inversion is both a mediocre indicator and ubiquitous, which means that the consequences of it simply occurring is likely already well priced into stock markets either directly or indirectly. The sheer widespread recognition of it almost by definition erodes the alpha.

Predicting Economies Is Hard, Stop Looking for the Golden Goose

Those folks who have been around macro long enough appreciate that predicting what is likely to transpire in the economy is hard. There are always significant cross cutting pieces of data that will suggest expansion and contraction at any point in time. That challenge magnified post covid where supply & demand bullwhips have also degraded many traditional measures and linkages.

With so much uncertainty more information is better. Those folks who have navigated the last couple years well have flexibly incorporated a wide range of data to get a comprehensive picture of the economy and adjusted their positions, particularly during periods of extreme market positivity or pessimism. Those that were stuck on single indicators struggled to find the signal through the fog.

It is time to retire yield curve inversion to the dustbin of history. It is a mediocre predictor of recession over a time frame relevant to investors and it sucks as an equity indicator.

Footnotes:

* I was inspired to look into just how good the yield curve is as an indicator after hearing Jack Farley’s interview with Campbell R. Harvey. If you don’t regularly listen to Jack’s pod Forward Guidance you are missing out.

For informational and educational purposes only and should not be construed as investment advice. The historical analysis should not be construed as an indicator of future performance. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment. No Representation is being made that any investment will or is likely to achieve profits or losses similar to those shown herein.